San Francisco Bay Area Residential Real Estate Trends: December 2025 Market Report

The Bay Area is entering its typical holiday slowdown, but the market isn’t completely halted. Sales of single-family homes and condos continue, albeit more slowly, with limited property availability. Mortgage rates have dropped to the low 6 percent range following the Federal Reserve’s rate cut in autumn, providing some relief for buyers. Inflation decreased to 2.7 percent year-over-year in November, while the U.S. economy added 64,000 jobs and the unemployment rate rose to 4.6 percent. These factors contribute to the Bay Area’s distinct housing pattern: a highly competitive luxury market and a cautious entry-level segment.

Local Market Insights: What’s Really Happening

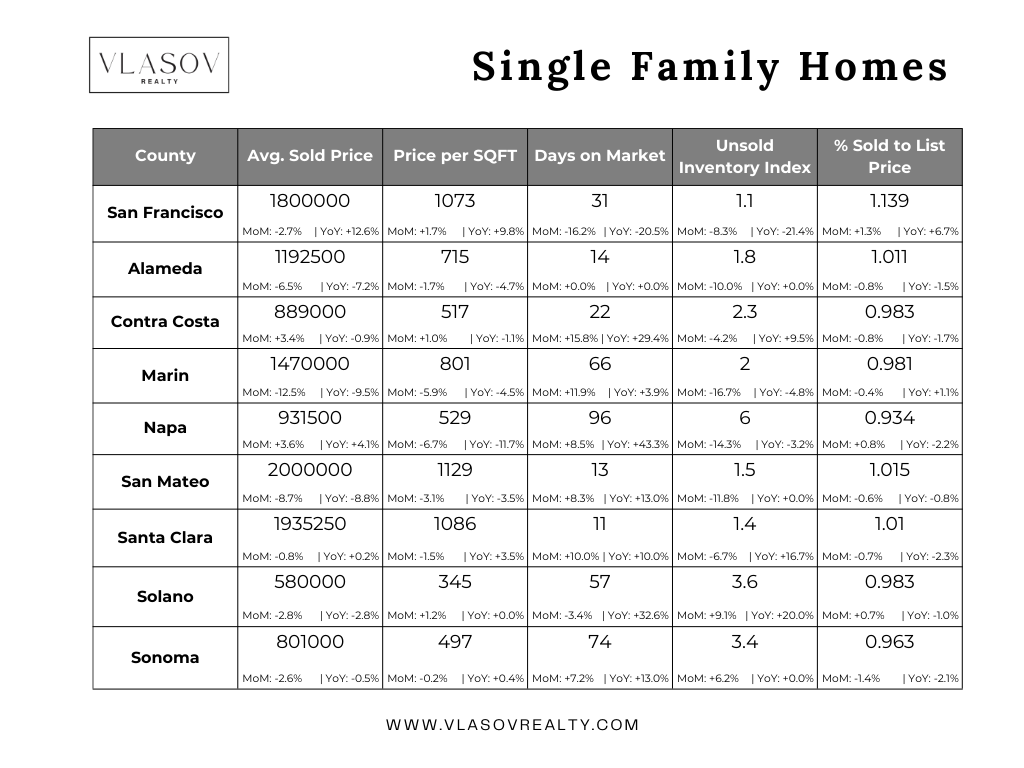

Single-family homes (SFH). In November 2025, the median price for single-family homes in the Bay Area was approximately $1.275 million, representing a decline of about 2% from October and 3% from the previous year. Sales decreased by roughly 22% month-over-month and 3% year-over-year. The average price per square foot was $725, slightly lower than in October. Homes generally sold for their asking prices, and the region's inventory stood at around 2.2 months. The median time on the market was twenty-five days, longer than last winter but still relatively brisk.

Condos and TICs. The median price for condos in the Bay Area was about $814,500, remaining nearly unchanged month-to-month and dropping about 3% compared to last year. Sales were approximately 20% lower than in October and 6% lower than last year. The average price per square foot was $647, down about 4% from the previous month. Condos typically sold slightly below their list prices. Inventory was roughly 3.2 months, and the median time on market increased to thirty-seven days.

Interpretation. Buyers remain active but selective. Sellers who set realistic prices are seeing their homes sell, while overpriced listings tend to stay on the market. The limited supply of homes is the crucial factor supporting current values. Condos present more room for negotiation, but attractive units in prime locations sell quickly.

What’s Driving This Market

-

A Holiday Chill. December always slows down, and this year is no exception. Buyers are distracted by travel and year‑end obligations, leading to fewer open-house visitors and bidding wars. In the East Bay, the average number of days on market rose to around thirty‑two, the slowest since 2019. Serious buyers see the lull as an opportunity: inventory is tight, and motivated sellers are more willing to negotiate.

-

Rates Retreat. Mortgage rates have decreased since their late summer peak. In early December, the average 30-year conforming rate was about 6.22 percent, reaching 6.243 percent on December 16. A quarter-point rate cut by the Federal Reserve in October, along with expectations for another cut, has eased monthly payments. Nonetheless, Fed Chair Jerome Powell has indicated there is limited scope for further reductions unless inflation or labor market conditions change significantly, which keeps rates mostly between six and 6.3 percent.

-

Tech and AI are fueling the upscale market. The Bay Area’s tech industry is driving a comeback in high-end property demand. The surge in AI startups has attracted high-income buyers, making San Francisco one of the hottest real estate markets nationwide. Consequently, single-family homes in the city sold for about 14 percent above their asking prices on average, with some sales surpassing by sixteen percent. Tech salaries and stock options are less affected by small interest rate shifts, enabling buyers to continue bidding strongly on well-located, modern homes.

-

San Francisco’s inventory levels are approximately 35% lower for single-family homes and 40% lower for condos compared to last year. The supply remains below three months in most Bay Area counties. Affordability issues are driving first-time buyers to consider more distant counties or to opt for condos. Buyers unable to afford properties on the Peninsula are turning east to Contra Costa and Solano or shifting their focus to condos. This creates a market characterized by high-end segments booming while entry-level markets soften, illustrating the K-Shaped market today.

County Highlights

San Mateo and San Francisco continue to be the dominant players in the market. The median price for single-family homes in San Mateo is approximately $2 million, with homes averaging around thirteen days on the market. Prices still tend to sell slightly above asking, although they have decreased by nearly nine percent month over month. There is strong demand for renovated homes located near employment centers. In San Francisco, the median price for single-family homes is about $1.8 million, with a price per square foot just over $1,070. Homes typically remain on the market for approximately thirty-one days, yet competitive bidding often results in sale prices exceeding the list price. Inventory remains extremely tight, at just over one month’s supply.

In Santa Clara, the median price for single-family homes is approximately $1.94 million, remaining nearly unchanged year over year. Sales have decreased by over twenty percent since October and sixteen percent compared to the previous year. Homes typically sell in about eleven days, with a price per square foot slightly above $1,080. Buyers are well-informed and tend to challenge overpricing. Well-maintained homes continue to sell quickly, but listings that are overpriced tend to stay on the market longer.

Alameda's median home price is approximately $1.19 million, reflecting a 6.5% decrease from October. The price per square foot stands at about $715, and homes generally sell for slightly above their list prices. The current inventory is roughly 1.8 months, with a median market duration of just fourteen days. Alameda strikes a balance between competitiveness and accessibility, making it appealing to East Bay tech professionals who seek affordability and manageable commutes.

Marin, Napa, and Sonoma are popular among lifestyle buyers, who hold sway in these northern counties. Marin’s median home price is approximately $1.47 million, a decrease of nearly 10% from last year, with homes typically selling in about 66 days. Napa’s median price stands at roughly $ 931,500, reflecting a 4% increase year over year, but high inventory levels and longer marketing periods give buyers some advantage. Sonoma’s median price is around $801 , with about 3.4 months of inventory, and homes generally stay on the market for 74 days. In these areas, buyers value space and natural beauty, which provides them with more opportunities to negotiate.

Contra Costa and Solano counties are key to affordability. Contra Costa’s median single‑family home costs around $889 , with a price per square foot of approximately $517. Homes typically stay on the market for about twenty‑two days, and inventory is roughly 2.3 months. Prices have slightly increased month-to-month. Solano’s median price is approximately $580 , with a price per square foot of about $345. Inventory there is about 3.6 months, and homes spend around fifty‑seven days on the market. These regions provide the lowest price options in the Bay Area and maintain steady demand, though longer market times give buyers more room to negotiate.

Condos and TICs: Urban Revival and Affordability

In San Francisco, the median condo price has risen to approximately $1.2 million, an increase of over 7% year-over-year. While sales dropped by nearly 30% from October, they remain slightly higher than last year. The price per square foot is around $ 1,031. Inventory levels are approximately 2.4 months, and condos stay on the market for about sixty‑one days. The return of tech workers to offices and the increased vibrancy of cities have revitalized the condo market. Units in desirable buildings tend to sell at or above the asking price, while an abundance of older, less updated condos presents value opportunities. Marin and Napa also enjoy strong markets. Marin’s median condo price is about $735 , and Napa’s is roughly $ 687,000, both experiencing double‑digit gains compared to last year. Inventory is higher here, around 3.8 months in Marin and close to 9 in Napa, giving buyers plenty of options, though the average time on market exceeds 2 months. In Santa Clara and Alameda, condo prices have decreased. Santa Clara’s median price of approximately $ 960,000 has fallen 7% from last year. Alameda’s median of about $ 692,500 is over 10% lower. Inventory ranges from about 2.7 to 3.6 months, with condos spending between 21 and 37 days on the market. Buyers have more negotiating power, and many sellers are offering concessions. Contra Costa, Solano, and Sonoma have more affordable condos. Contra Costa’s median price is about $582, with about 4 months of inventory and condos averaging about 27 days on the market. Solano’s median is approximately $332 , with about 4.3 months of inventory and condos staying around 47 days. In Sonoma, the median price is $422 , with similar inventory levels and nearly 73 days on the market. These markets offer entry‑level options but can be volatile month‑to‑month, so patience is key.

Macro Market Overview

The national housing market remains steady, with average home values in the U.S. around $368,581, only slightly higher than last year. Since reaching a peak in February 2025, prices have slightly declined. Inventory levels have increased modestly, with nearly 1.4 million homes listed on Zillow in July 2025. Inflation has eased, and mortgage rates have stabilized in the low six percent range. In November, the U.S. labor market added 64,000 jobs, but unemployment rose to 4.6%, the highest in over four years.

California reflects these national trends, but at higher prices. In November, the median price for single-family homes statewide was approximately $852,680. The unsold inventory index stands at about 3.6 months statewide, compared to 2.2 months in the Bay Area, highlighting the region’s ongoing scarcity. Mortgage rates between 6 and 6.3 percent are manageable for many Californians, but homeowners with ultra-low pandemic-era mortgages remain hesitant to list, keeping supply limited.

Economic Forces

The labor market is cooling down. In November, the U.S. added 64 jobs, and the unemployment rate increased to 4.6 percent. While hiring in the tech sector remains steady, hiring in other industries is slowing. Fewer homeowners are relocating, especially those with ultra‑low mortgage rates, resulting in lower turnover. California still experiences net out‑migration, but at a slower rate, and international immigration is starting to pick up again.

Inflation decreased from around 3 percent in September to 2.7 percent in November. This drop in inflation should eventually lower mortgage rates, but the Federal Reserve remains cautious. Chair Jerome Powell has stated that further rate cuts depend on clear signs of cooling inflation and a softer job market. Consumer confidence signals are mixed: some buyers are optimistic about tech‑driven job growth and refinancing opportunities in 2026, while others remain cautious amid economic uncertainty.

Housing Policy and Development

The policy environment remains dynamic. In San Francisco, a proposed Family Zoning Plan would allow taller, denser buildings in traditionally single‑family areas, potentially adding tens of thousands of homes. A rent‑control incentive proposal could let developers bypass some affordability mandates in exchange for capping rents on all units. The city is also simplifying its accessory dwelling unit rules to remove some appeals and increase size limits. Across the Bay Area, state bills encourage upzoning near transit stops, streamline environmental reviews for infill projects, and require buyers to sign a written representation agreement before submitting an offer. Oakland has adopted 2025 building code amendments that tighten seismic and fire standards and streamline permitting. These changes may modestly increase construction costs but should improve safety and expedite development. Policy shifts matter because they influence future supply. Increased density near transit and streamlined approvals could ease the inventory crunch, though benefits will take years to materialize.

Mortgage Rates: A Calmer Landscape

Mortgage rates no longer lurch week to week. The 30‑year conventional rate averaged just over 6.24 percent in mid‑December and has hovered between six and 6.3 percent throughout the month. Fifteen‑year loans sit in the high‑five percent range, and adjustable‑rate mortgages just above six. Economists expect rates to remain in this band through 2025, with a possible dip into the high‑five percent range if inflation continues to cool. This stability lets buyers plan budgets more confidently; many are strategizing to buy now and refinance if rates move lower in 2026.

Local Sentiment

The Bay Area market continues to be K-shaped. On the high end, competition remains intense. Tech wealth, stock market gains, and remote work flexibility sustain strong demand for single-family homes in San Francisco, San Mateo, and Santa Clara, where overbidding is common and luxury properties tend to sell quickly. At the entry level, increased borrowing costs and higher down payment requirements limit first-time buyers. Many are turning to condos or outlying counties, which offer lower prices and more inventory. The December holiday slowdown highlights this divide: high-end buyers are still seeking trophy properties, while budget-conscious shoppers wait for the spring market rebound.

Whether it's the holiday season or not, we are strategizing for a successful move in the new year. Contact me today to start planning your 2026 move.

Happy Holidays!

Recent Posts

Stay In The Know - Subscribe To Market Updates

LET'S GET IN TOUCH