San Francisco Bay Area Residential Real Estate Trends: September 2025 Market Report

Fall Market Awakening After Labor Day

After a quiet August, the Bay Area real estate market is starting to come alive. Families have wrapped up summer vacations and are back in town, which means more buyers are touring listings. Inventory is still tight in most counties, but it’s up from spring levels, and new listings are trickling onto the market after Labor Day. At the same time, mortgage rates have edged down slightly: Money’s daily survey shows the average 30‑year fixed loan at 6.37 % on September 11, and Freddie Mac’s weekly survey puts the 30‑year rate at 6.35 %, both modest declines from late August. Sellers still have the upper hand in many areas, but buyers have a bit more breathing room and financing costs that are just a hair lower than a few weeks ago.

On the national stage, home prices remain resilient. In July (the latest month with complete data), the median sale price in the U.S. was $443,462, up 1.4 % year‑over‑year, even as the number of homes sold dipped slightly. California’s market looks similarly sturdy: the state’s July median sale price was about $828,900, down less than one percent from a year earlier, with roughly 25,000 homes sold and a median 44 days on market. In other words, prices are holding up even though high mortgage rates have cooled demand. That stability is one reason buyers and sellers in the Bay Area remain confident heading into the fall.

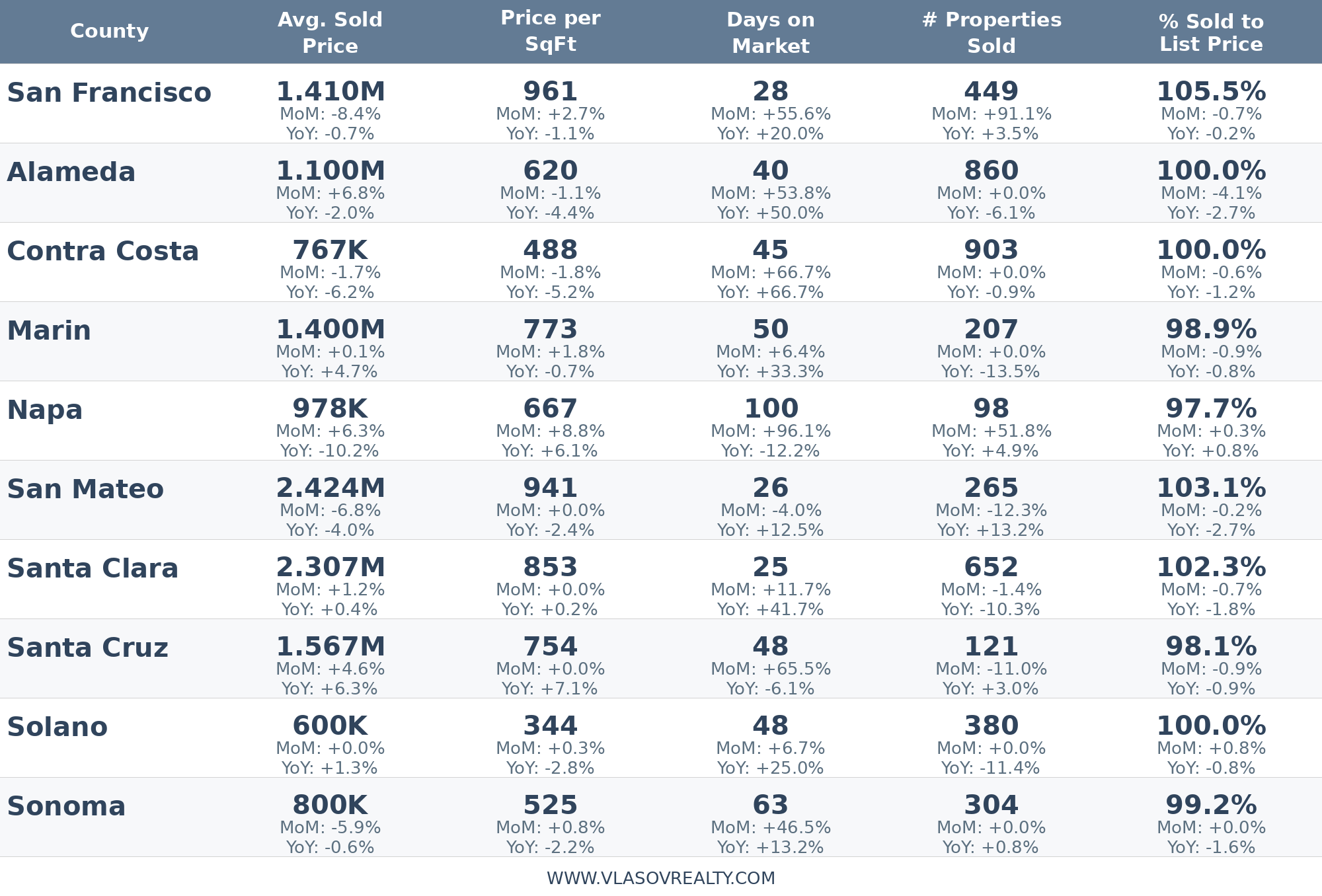

County Highlights and Local Flavor

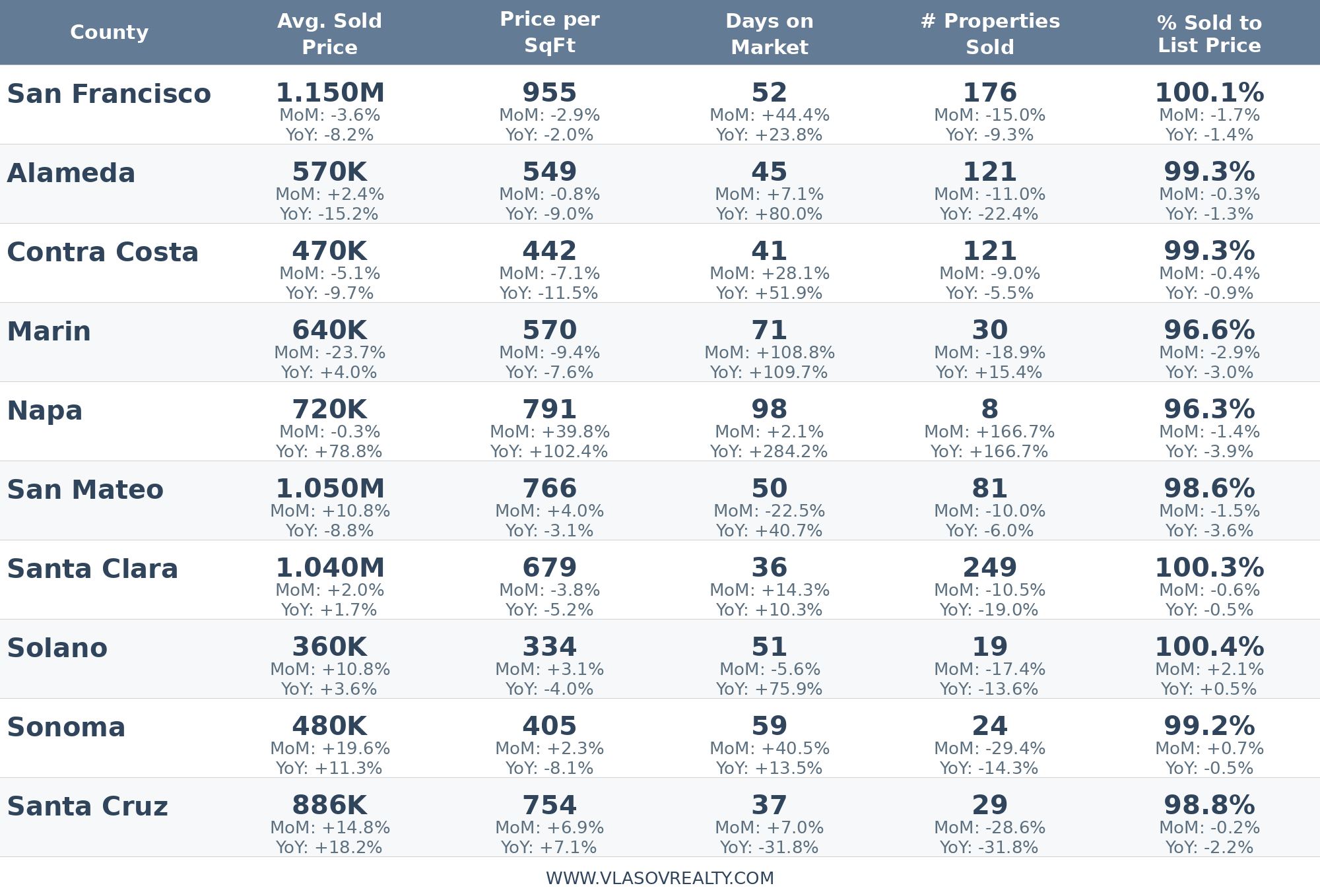

San Francisco. The city continues to command premium prices for single-family homes; the median sale price was approximately $1.41 million in July, and sales in August and early September suggest little change. Homes sell after roughly 28 days on market and still achieve 105.5 % of list price on average. Neighborhoods like Noe Valley, Bernal Heights, and the Outer Sunset continue to be magnets for families seeking good schools and walkable communities. Condos are a different story: they offer better relative value, with median prices around the low‑$1 million range and marketing times often exceeding 50 days. Buyers who want a foothold in the city without the expense of a single‑family house will find more options and negotiating room in the condo/TIC market.

East Bay – Alameda & Contra Costa. Alameda County is a study in contrasts: Oakland’s urban core remains popular with buyers seeking a vibrant city lifestyle, while suburbs like Berkeley and Fremont offer larger lots and strong schools. Single‑family homes sell in the low‑$1 million range with roughly a month on market, and sellers still average a few points above list price. Contra Costa County offers even better affordability, with typical homes in the high $700,000 range and sale-to-list ratios near 100%. Its suburban neighborhoods (Lamorinda, Walnut Creek, Danville) attract buyers looking for more space and good schools without Silicon Valley price tags. Both counties saw modest price declines over the summer but remain stable heading into fall.

Peninsula – San Mateo & Santa Clara. These counties remain the Bay Area’s most competitive markets thanks to their proximity to tech giants and strong school districts. In San Mateo County, single-family homes still command around $2.6 million, with selling times of about 25 days and sale-to-list ratios over 102%, reflecting frequent bidding wars. Santa Clara County is nearly as intense; median prices hover around $2.3 million, days on market sit near 23 days, and sellers receive roughly 103 % of their asking price. Expect these markets to heat up further this fall as well‑funded buyers return from vacation; being pre‑approved and ready to act quickly is essential.

North Bay – Marin, Napa, Sonoma & Solano. Marin County offers a picturesque coastal lifestyle and some of the Bay Area’s priciest real estate, but its market is slower: single‑family homes spend about 45–50 days on market, and sale‑to‑list ratios are just under 100%. Buyers can negotiate here, and the county appeals to those seeking outdoor recreation and easy access to both San Francisco and wine country. Napa County is unique; luxury estates and vineyard properties dominate, and inventory is thin. Condo prices jumped sharply over the past year, but days on market remain high, reflecting the niche nature of the inventory. Sonoma and Solano counties offer more affordable options, single‑family homes often sell in the $600–$850 range with longer marketing periods. These areas attract buyers looking for space, quieter towns, and a wine‑country lifestyle without Napa’s price tag.

Santa Cruz. The coastal county straddles surf culture and Silicon Valley commuters. Single‑family homes sell in the $1.5 million range and spend about a month to six weeks on the market, while condos typically run under $900k. Inventory is tight because many owners hold onto their beach properties, so well‑presented listings can still generate multiple offers. Buyers willing to consider a townhome or TIC will find slightly more choices.

Single Family Homes

Condos and TICs

Bigger Picture and Mortgage Rates

On the macro front, the economy is showing mixed signals: inflation is trending lower, but job growth remains solid. That’s why mortgage rates haven’t fallen dramatically, lenders are watching Federal Reserve policy and the 10‑year Treasury yield closely. As of mid‑September, the average 30‑year fixed mortgage is around 6.35 %–6.37 %, slightly lower than a month ago. The Fed is widely expected to cut its benchmark rate by 0.25 points soon, and lenders have already priced that in. Don’t expect rates to plummet, however; if inflation ticks up or investors demand higher yields, mortgage rates could creep back toward 7%. Buyers should stay nimble: lock a rate if it works for your budget, and be prepared to refinance later if rates drop more meaningfully. Sellers should keep in mind that buyers’ borrowing power remains constrained; pricing competitively and presenting your home beautifully are still key to attracting strong offers.

What to Expect This Fall

Historically, the Bay Area market re‑energizes after Labor Day as families settle back into routines. Early September showings suggest that the pattern is repeating, with new listings drawing healthy traffic and some homes receiving multiple offers. Tight inventory will keep upward pressure on prices in the most desirable neighborhoods, especially in San Mateo, Santa Clara, and parts of San Francisco. Outlying counties like Marin, Napa, Sonoma, and Solano offer more breathing room and may be slower to react, giving buyers greater leverage and the chance to negotiate favorable terms. Condos and TICs remain attractive for those looking for a lower‑maintenance alternative to a single‑family home, particularly in San Francisco and the East Bay.

Whether you’re buying or selling, this fall market presents opportunities. Buyers should get pre‑approved, monitor mortgage rates, and be ready to act quickly in hot neighborhoods or take advantage of softer condo markets. Sellers should prepare their homes now by decluttering, staging, and pricing realistically to capture renewed post-vacation demand. The Bay Area’s real estate landscape is nuanced; a local expert can help you navigate county-by-county dynamics and make the most of these market conditions. Please reach out if you’d like a personalized update or strategy session. We’re here to help you move confidently this fall.

Recent Posts

Stay In The Know - Subscribe To Market Updates

LET'S GET IN TOUCH